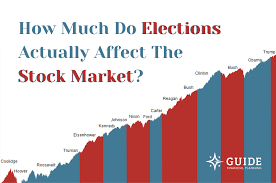

Stock markets are highly influenced by elections. The stock market, where individuals trade their shares in companies, indicates people’s feelings to the economy. With an election year coming up, fear and uncertainty about what future government policies will look like under Democratic rule has caused concern among investors. Taxes, Spending, and Regulations are all driven by different political parties that result in business profits. This uncertainty causes chaos behavior in the stock market as investors try to react and predict potential outcomes.

Elections influence the stock market mainly through policy changes. For Example, if a candidate promises to cut corporate taxes, investors might anticipate that company profits will rise and stock prices increase. On the other hand, if a candidate intends to tax more or add more regulations to healthcare investors might be concerned about how earnings will be affected. Possibly leading to stock prices potentially falling.

Election years and the periods of time leading into and following an election are usually volatile in the markets when investors rally for certain investment groups based on initial reports.

And the stock market has an effect on election results as well. The market does better when more people support these views and generally feel better about the economy which can benefit who led us before. But if the market performs poorly, voters may lose faith in the government.

This may have been the case this election.